Copper Price Trends 2025: An Analysis of Current Dynamics and Future Forecasts

Copper, often called "Dr. Copper" for its ability to diagnose the global economic health, has demonstrated a mix of resilience and volatility in 2025. In this blog post, we’ll break down the price trends so far, explore the driving factors, and look ahead at what to expect in the coming months—backed by data and market insights.

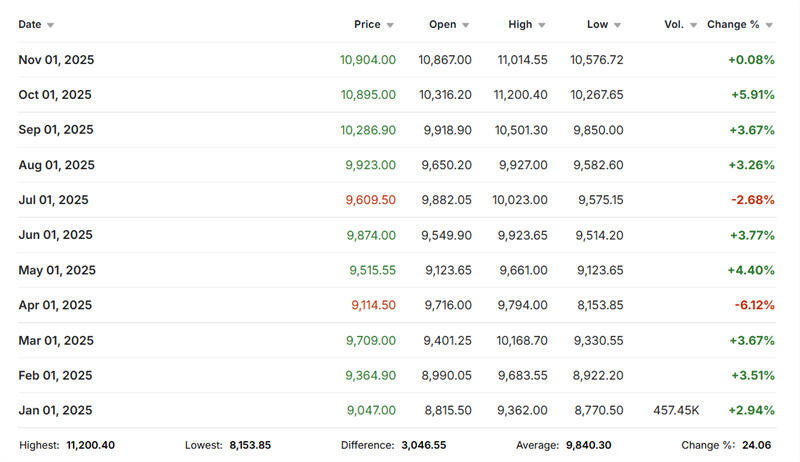

Year-to-Date Copper Price Performance

In 2025, copper prices have largely traded within a high range, influenced by a combination of supply constraints, geopolitical developments, and evolving demand trends.

- Q1 2025: Prices started strong, with LME copper reaching $10,050 per tonne in March . This surge was supported by tight supply conditions and robust demand from sectors like renewables and electric vehicles (EVs).

- Q2 2025: Prices experienced a temporary dip in April, with a sharp correction triggered by U.S. tariff announcements and weaker seasonal demand. However, the market quickly found its footing as supply concerns resurfaced .

- Mid-Year Stability: By June, LME three-month copper averaged $9,445.4 per tonne, while Shanghai Futures Exchange (SHFE) three-month copper averaged 77,243.2 yuan per tonne .

Key Factors Influencing Copper Prices in 2025

1. Persistent Supply-Demand Imbalance

- Supply Constraints: Global copper mine supply has been repeatedly disrupted due to accidents, geopolitical issues, and underinvestment. Major producers like Chile, Peru, and the Democratic Republic of Congo faced operational challenges, tightening the market further .

- Strong Demand: The clean energy transition continues to fuel copper demand. EVs, solar panels, wind farms, and power infrastructure projects all rely heavily on copper. For instance, each electric vehicle uses about 83 kg of copper .

2. Geopolitical and Policy Impacts

- U.S. Tariff Policies: The U.S. government’s consideration of tariffs as high as 25–50% on copper imports created market distortions, including inventory hoarding and shifts in trade flows .

- Regional Tensions: Events such as the paused production at the Cobre Panama mine and trade friction between major economies added a risk premium to prices .

3. Macroeconomic Environment

- Monetary Policy: Expectations of interest rate cuts by the Federal Reserve and other central banks have supported metal prices. A weaker U.S. dollar also made dollar-denominated copper cheaper for international buyers .

- Global Growth Concerns: While the U.S. and parts of Europe showed resilience, China’s slower-than-expected recovery in key sectors like real estate tempered bullish sentiment .

4. Inventory Levels

- Low Visible Inventories: LME copper stocks fell to as low as 95,900 tonnes, down 62% year-on-year, creating a tight physical market .

- U.S. Stockpiling: In contrast, U.S. copper inventories (including unreported stocks) surged to over 100 days of consumption, distorting global inventory patterns .

Copper Price Forecast: Next 3 and 6 Months

Next 3 Months (End of Q1 2026)

In the short term, copper prices are expected to remain elevated but range-bound.

- Price Projection: Institutions like Goldman Sachs expect LME copper to trade around $9,600 per tonne over the next three months .

- Reasons:

Seasonal demand softness may be offset by persistent supply tightness.

The market will closely watch the U.S. tariff policy timeline and the Federal Reserve’s monetary policy decisions .

Next 6 Months (Mid-2026)

Looking further ahead, the consensus tilts toward a moderate upward trajectory.

- Price Projection:

- Goldman Sachs forecasts copper at $10,000 per tonne in six months and $10,700 per tonne in 12 months .

- Morgan Stanley and UBS are also optimistic, projecting prices around $10,400–$11,000 per tonne by mid-2026 .

- Reasons:

- Structural deficits are expected to widen, with the global supply gap potentially reaching 270,000 tonnes by the end of 2025 .

- Demand from renewables, EVs, and global infrastructure programs is set to accelerate.

Investment Considerations

For those looking to gain exposure to copper:

- Copper Futures & CFDs: Offer leverage and flexibility, suitable for investors who can manage short-term volatility .

- Copper ETFs and Mining Stocks: Provide a lower-risk avenue for long-term exposure to the copper theme .

- Monitor Key Catalysts: Keep an eye on U.S. trade policies, mine supply updates, and macroeconomic indicators like the U.S. dollar and global PMI data.

Conclusion

Copper’s role in the global economy—especially in the clean energy transition—has kept it in the spotlight in 2025. While prices may experience short-term fluctuations due to policy shifts or demand variations, the underlying supply-demand imbalance supports a bullish medium-term outlook.

Investors and industry stakeholders should stay alert to geopolitical and policy developments while recognizing copper’s long-term strategic importance.